As we saw last week in Fort Lauderdale, flood damage is devastating. The city received over 25 inches of rain in an unprecedented storm that flooded roads, swamped cars, and stranded travelers. This happened outside of hurricane season. According to meteorologists, it was worse than the rainfall from most hurricanes. Preparing for flood damage can help minimize its impact on your home and property. Here are some steps you can take to prepare for a potential flood:

1. Know Your Risk

Find out if you live in a flood-prone area and understand the level of risk you face. You can check with your local emergency management agency, the National Flood Insurance Program, or the FEMA Flood Map Service Center.

2. Purchase Flood Insurance

Flood insurance can help protect your property and possessions in the event of a flood. Flooding is typically not covered with your homeowner’s insurance policy, but is a separate policy purchased from the National Flood Insurance Program (NFIP).

3. Prepare Your Home

Elevate critical utilities, such as electrical panels and water heaters, to higher floors or platforms. Install backflow valves on pipes to prevent floodwater from entering your home. Waterproof caulking and seals around windows and doors to prevent water from entering your building. Store important documents and valuables in waterproof containers on higher floors.

4. Create an Emergency Plan

Develop an emergency plan with your family and practice it regularly. Include a plan for evacuation, communication, and meeting points.

5. Create an Emergency Kit

Keep a supply of non-perishable food, water, batteries, and first aid supplies in case of an emergency. Sandbags can be used to block water from entering your building through windows or doors.

6. Get Annual Roof Inspections

Regularly inspect your roof for leaks and make necessary repairs to prevent water damage.

7. Maintain Proper Grading & Drainage

Make sure your property has proper grading and drainage to prevent water from pooling near your building.

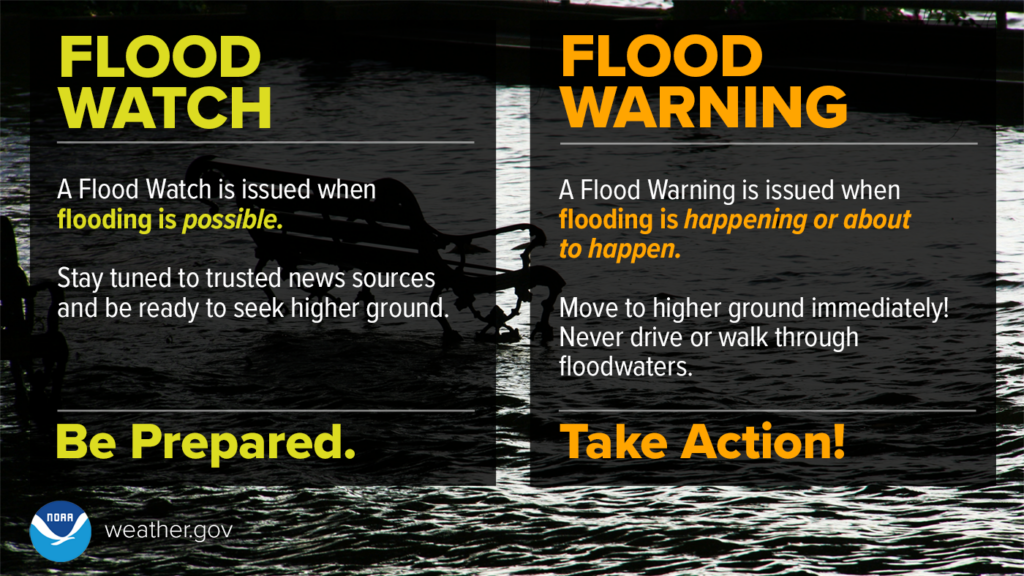

8. Know the Difference Between a Flood Watch & Flood Warning

By taking these steps, you can help minimize the impact of flood damage on your home and property.

Insurance Claim: Flood Damage vs. Water Damage

The main difference between a flood claim and a water damage claim is where the water comes from. With flood damage, the water comes from a natural source and two or more properties must be involved. A flood is defined as rising water as a result of bodies of lakes, rivers, streams, and oceans, but there are many possible natural causes of flooding such as heavy rain, melting snow, flash floods, hurricanes, tropical storms, land development, and broken dams.

If you end up in the unfortunate situation where you do require to file a claim for flood damages to your commercial or personal property, it’s important to remember that you have the right to choose your own Contractor for repairs, so make sure to choose one that’s reputable and experienced to ensure that your property is fully restored back to pre-loss condition. You can also choose to use a Public Adjuster to represent your claim and get you the maximum compensation you deserve.

Have You Experienced Flood Damage? Contact Cordo Claims Group!

If you have insurance coverage for flooding and need help on your claim, contact our expert Public Adjusters at Cordo Claims Group or call 1-877-55-CORDO (1-877-552-6736) for a free policy review. With over 20 years of industry experience, we help residential and commercial property owners throughout Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Texas, Virginia, West Virginia, and Colorado. We work on your behalf to ensure you obtain a fair and balanced settlement.